Consumer Confidence Cautiously on the Rise in Ottawa Resale Market

November 6, 2024

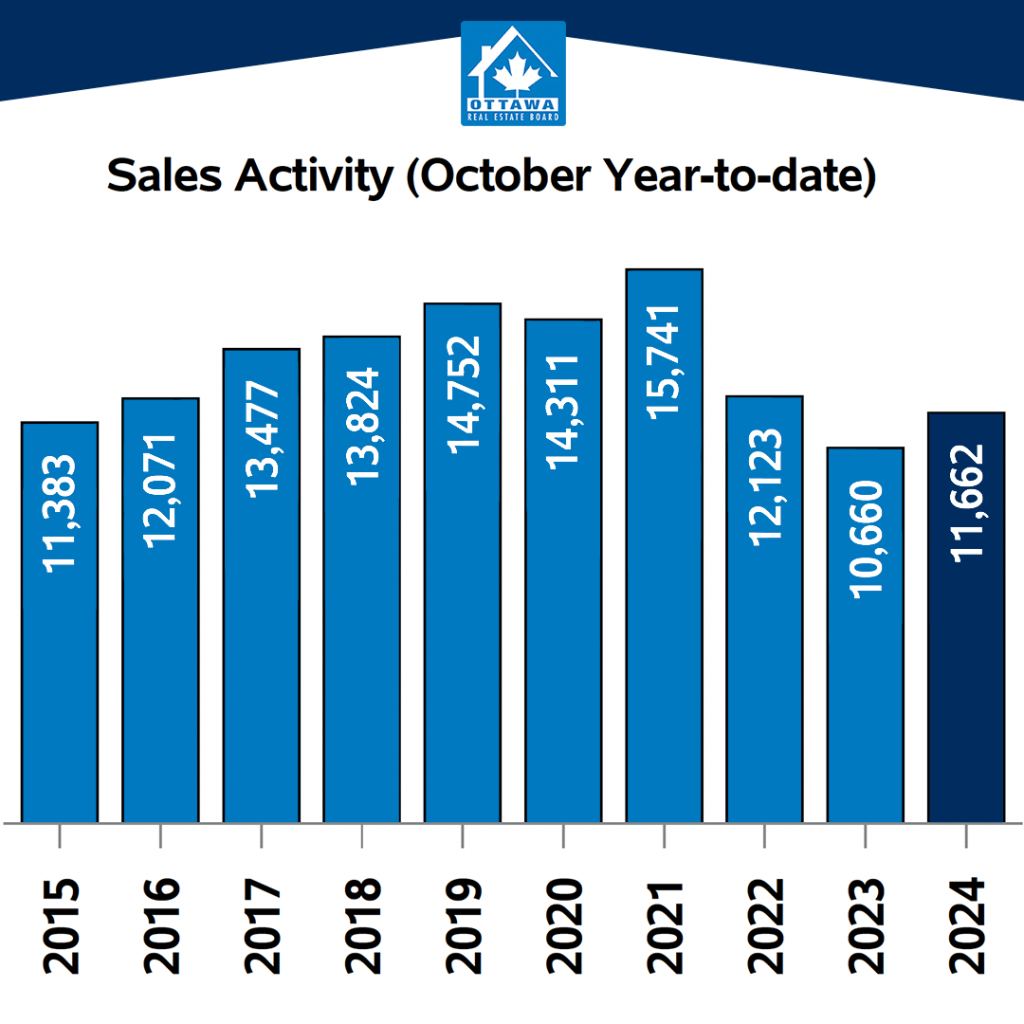

The number of homes sold through the MLS® System of the Ottawa Real Estate Board (OREB) totaled 1,179 units in October 2024 — an increase over the 1,047 units sold last month.

Home sales were 3.9% below the five-year average and 0.9% below the 10-year average for the month of October.

On a year-to-date basis, home sales totaled 11,662 units in October 2024 — an increase of 9.4% from the same period in 2023.

“We’re seeing positive movement in Ottawa’s market with sales activity up,” says OREB President Curtis Fillier. “This is especially interesting because there has been sustained activity throughout the year instead of the typical seasonal spikes and lulls. Consumer confidence is getting stronger, boosted by another consecutive Bank of Canada interest rate cut — though many are waiting for additional rate drops.”

The 50-basis-point reduction might offer optimism following Ontario’s tabling of the Fall Economic Statement where housing starts projections were scaled back to 81,300, representing another reduction in projections and is even further from the province’s goal of creating 125,000 new homes in 2024. The Ontario government cites high interest rates and a tough economic environment as pervasive challenges for homebuilders.

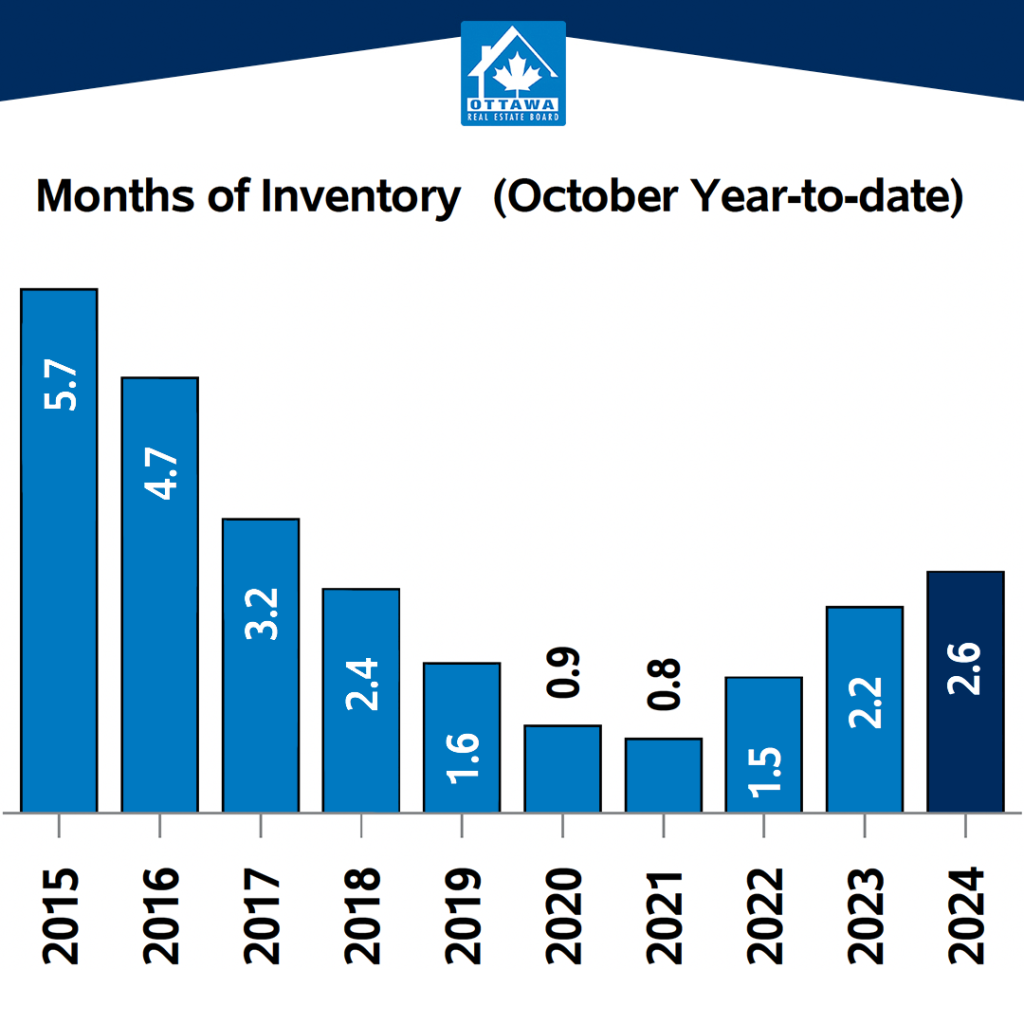

“The challenge remains supply,” says Fillier. “We know from experience that Ottawa’s inventory leans tight and can swing quickly from balanced territory to a seller’s market — which can compound affordability and accessibility challenges. Now is always the time for fresh action and innovative policies that can create much-needed inventory.”

OREB leaders and volunteers recently joined the Canadian Real Estate Association on Parliament Hill to present focused solutions to confront the ongoing housing supply crisis. With expertise and experience in market conditions and consumer needs, REALTORS® advocated to stimulate supply by investing in offsite construction technologies (i.e. prefabricated homes) and extending HST/GST relief for non-profit-built affordable ownership housing.

By the Numbers – Prices:

The MLS® Home Price Index (HPI) tracks price trends far more accurately than is possible using average or median price measures.

- The overall MLS® HPI composite benchmark price was $639,500 in October 2024, an increase of 0.4% from October 2023.

- The overall MLS® HPI composite benchmark price was $639,500 in October 2024, an increase of 0.4% from October 2023.

- The benchmark price for single-family homes was $724,500, up 0.7% on a year-over-year basis in October.

- By comparison, the benchmark price for a townhouse/row unit was $506,900, up 1.6% compared to a year earlier.

- The benchmark apartment price was $407,500, down 3.4% from last year.

- The average price of homes sold in October 2024 was $668,690 increasing 1.2% from October 2023. The more comprehensive year-to-date average price was $678,081, increasing by 0.9% from October 2023.

- The dollar volume of all home sales in October 2024 was $788.3 million, up 47.7% from October 2023.

OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Prices will vary from neighbourhood to neighbourhood.

By the Numbers – Inventory & New Listings

-

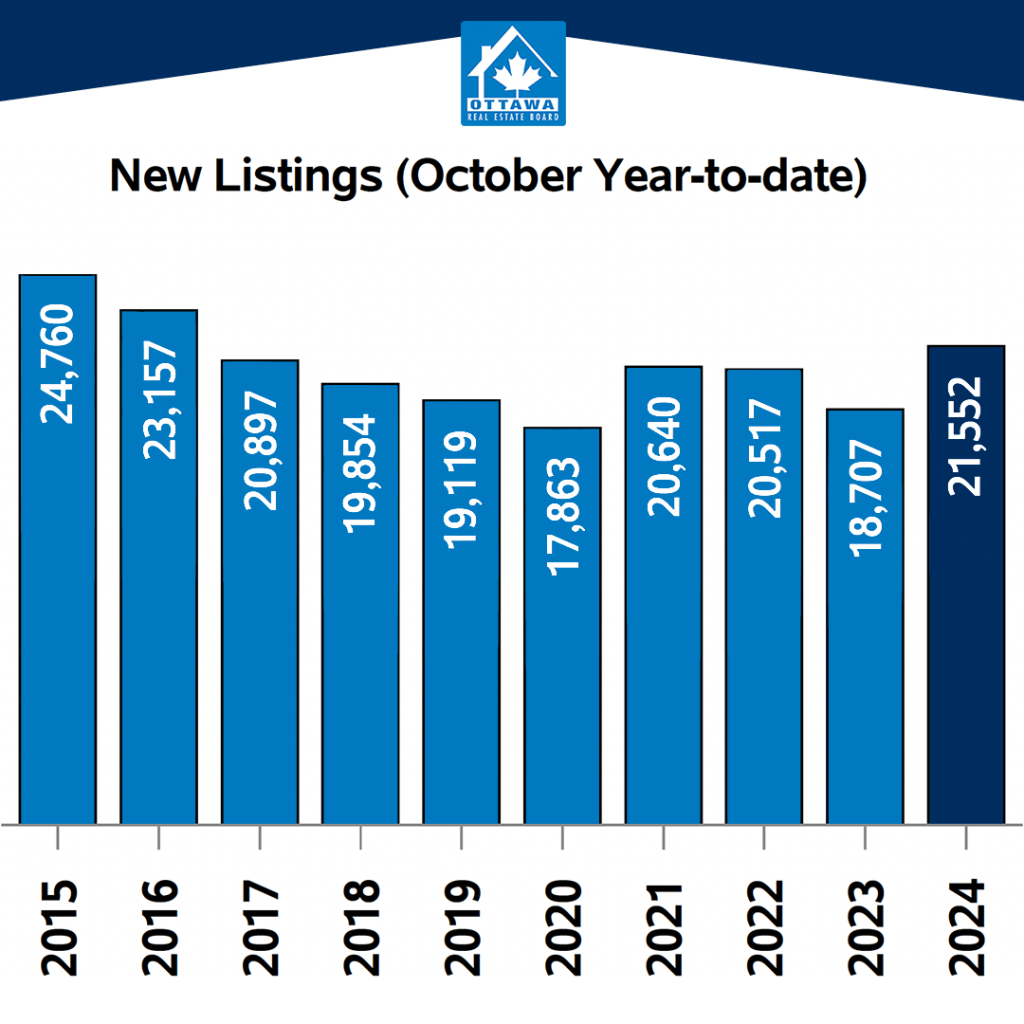

- The number of new listings saw an increase of 10.4% from October 2023. There were 2,089 new residential listings in October 2024. New listings were 6.7% above the five-year average and 17% above the 10-year average for the month of October.

-

- Active residential listings numbered 3,354 units on the market at the end of October 2024, a gain of 8.9% from October 2023. Active listings were 40.6% above the five-year average and 6.7% above the 10-year average for the month of October.